3 Crypto Stocks That Cathie Wood Is Betting Big on Here

The comeback story that growth investors have been waiting for appears to be unfolding in real time. After weathering a brutal stretch that saw her flagship ARK Innovation ETF (ARKK) lose nearly 80% of its value from its 2021 peak to its trough in October 2023, Cathie Wood is proving that she has learned from her mistakes. ARKK is up 66% in the past year, and investors are starting to regain confidence in Wood again.

What makes this resurgence particularly noteworthy is how Wood's long-held crypto convictions are now being validated by the very institutions that once spoke ill of crypto, like J.P. Morgan (JPM), for example. Tens of billions have poured into the crypto market from multiple ETFs, and this is a complete reversal from the skepticism that dominated boardrooms just two years ago. Wood now believes Bitcoin (BTCUSD) will hit $2.4 million by 2030.

If you believe the next leg up is close, here are three crypto stocks she is betting on:

Circle (CRCL)

Circle (CRCL) had its initial public offering (IPO) quite recently, and it turned explosive. Things have cooled down in recent months as interest rate cuts are close, and this may be to Circle's detriment. Circle is the main issuer of USD Coin (USDC), and the company profits when individuals swap USD for USDC, which the company then uses to earn interest.

Regardless, Cathie Wood is clearly bullish here. She possibly believes the long-term boom in stablecoin use would eventually translate into a significant recovery for Circle and offset any declines from rate cuts.

This is a new company, so it is tough to say whether Wood sees it as a core holding or a shorter term play.

Cathie Wood owns $391.1 million worth of CRCL stock, with a 3.1% portfolio weight.

BitMine (BMNR)

Bitcoin mining companies have suffered significantly after the halving event. So much so that many of these companies started looking for similar industries to pivot to. Artificial intelligence (AI) was the lowest-hanging fruit, as Bitcoin miners already have plenty of computing.

BitMine (BMNR) is one of them, though it has focused more on doubling down on crypto instead of going into AI/data. The company wishes to become the “Ethereum version of MicroStrategy.” The goal is to accumulate significant amounts of Ethereum (ETHUSD) and then stake them. The company wishes to acquire 5% of all ETH. It initially raised $250 million in June 2025 and expanded to a potential $20-25 billion in additional fundraising capacity.

Cathie Wood owns $191.827 million worth of BMNR stock, constituting a 2.71% stake.

Coinbase (COIN)

Coinbase (COIN) is the biggest publicly traded crypto exchange company. This alone makes it one of the top choices if you want to invest in a crypto stock.

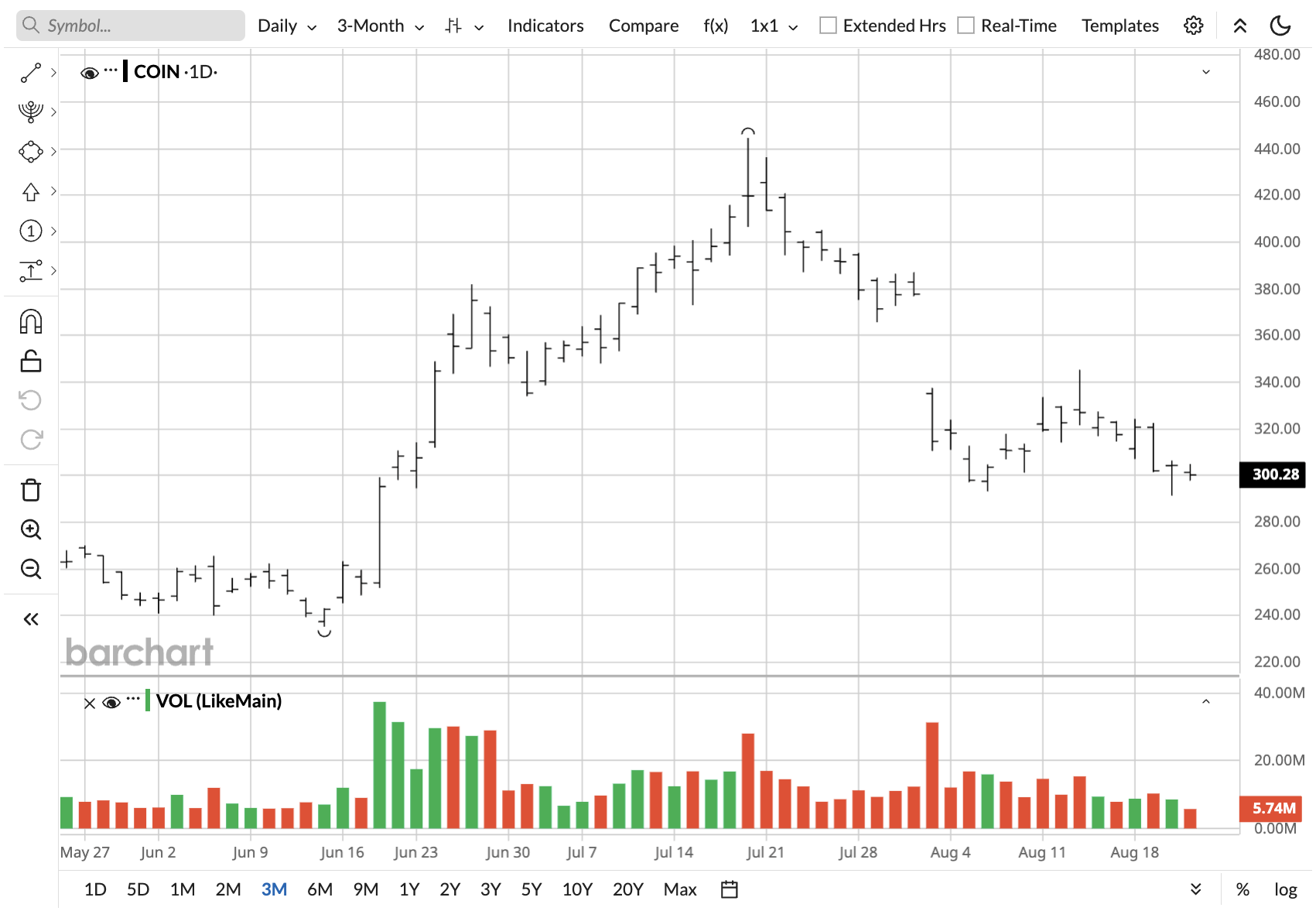

It has disappointed recently, as Q2 revenue only grew 2.91% and missed estimates by 6.06%. Coinbase blamed this on weaker trading volumes. Q3 may be when Coinbase does surprise with good earnings, as Ethereum has broken out strongly and driven up altcoin trading volumes.

Speaking of altcoins, we may be heading into altseason if Ethereum keeps gaining and Bitcoin stays plateaued. This would lead to an aggressive increase in trading activity.

COIN stock is already up 51.33% over the past year and is right above $300 as of this writing.

This is Wood's third-largest holding, worth $437.386 million, or a 6.18% weight.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.