As Chipotle Launches Drone Delivery, How Should You Play CMG Stock?

/Chipotle%20Mexican%20Grill%20logo%20on%20building%20by-%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

The restaurant industry is feeling the squeeze as consumers tighten their wallets, and even giants like Chipotle Mexican Grill (CMG) aren’t immune. Once the darling of fast-casual dining, Chipotle built its empire on bold flavors and a loyal following. However, 2025 has not exactly been a fiesta, with same-store sales dipping as traffic declined, prompting the company to reassess its growth strategy.

True to its digital-first DNA, Chipotle has doubled down on technology and delivery innovation. From seamless mobile ordering to app-exclusive promotions, the brand’s strategy targets a younger, convenience-driven audience. Now it is leveling up by partnering with drone-delivery leader Zipline to launch “Zipotle” in Dallas, where quiet, zero-emission drones will drop fresh burritos at your doorstep minutes after ordering.

From sci-fi dreams to doorstep reality – the futuristic bet is designed to reignite sales and deepen Chipotle’s appeal among Gen Z. But with CMG stock still struggling in 2025, should investors chase this flight?

About Chipotle Stock

California-based Chipotle Mexican Grill has built an empire on burritos, bowls, tacos, and salads crafted with responsibly sourced ingredients and zero artificial additives. With over 3,700 restaurants across the U.S., Canada, Europe, and the Middle East, it stands out as the only player of its size to fully own and operate all locations in North America and Europe. Backed by a loyal customer base and a $57.8 billion market capitalization, Chipotle’s brand has become synonymous with quality fast-casual dining.

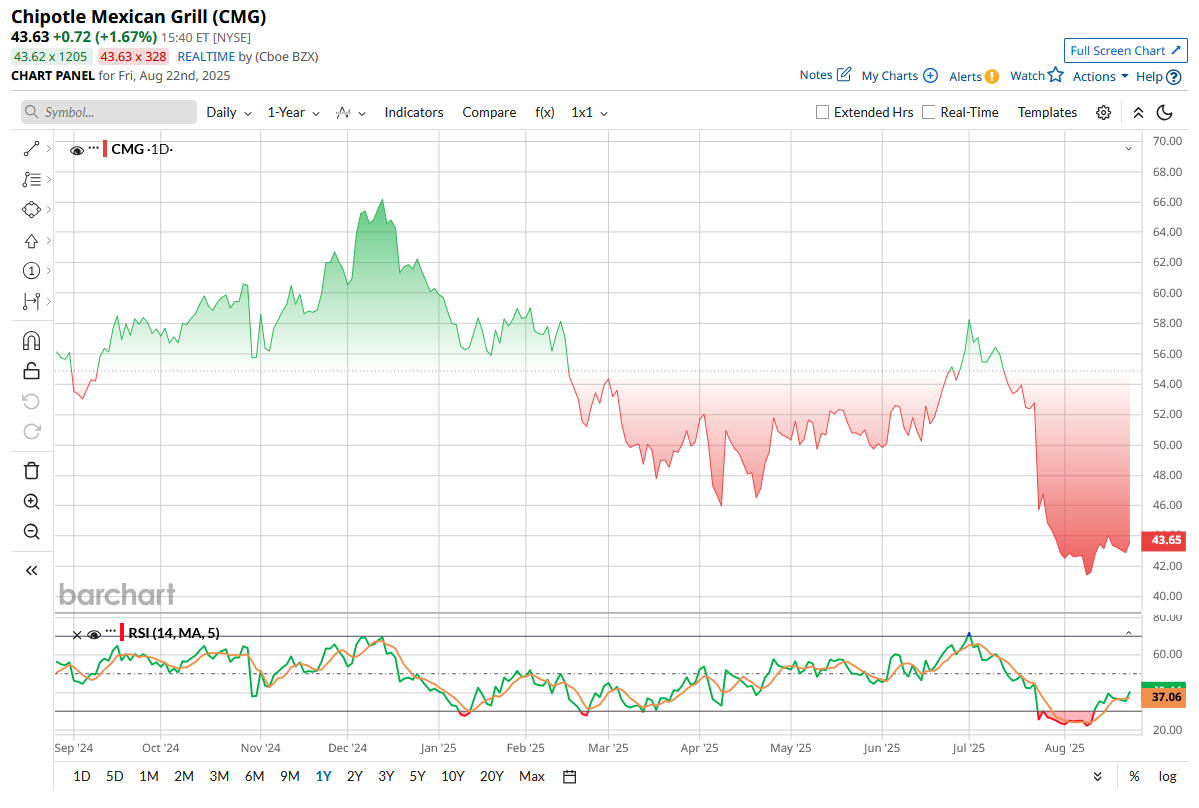

But Wall Street’s appetite has cooled. Despite its dominance, CMG stock has declined 18.3% over the past year and is down 27.6% on a year-to-date (YTD) basis. The 2025 selloff deepened this month as shares plunged by mid-teens after the Q2 report in July, and this month, it slipped to a 52-week low of $41.18, now trading uncomfortably close to those levels.

CMG stock isn’t cheap when compared to its sector peers, trading at 35.78x forward earnings and 5.13x sales, but context matters. Against its five-year average, the valuation looks far more reasonable. The premium reflects investors’ faith in Chipotle’s digital capabilities, expansion potential, and global growth prospects. CMG's turbulence may be a rare opportunity to snag the stock at a relative discount.

Chipotle Dips After Q2 Report

Chipotle Mexican Grill has long been the poster child of fast-casual dominance, but its second-quarter earnings report for 2025, released on July 23, felt more like a reality check. The burrito titan generated $3.1 billion in revenue, up just 3% year-over-year (YoY), and missing the projections. Comparable restaurant sales dropped 4% annually, signaling that organic growth slowed. The uptick came mainly from 309 new restaurants added over the past year, bringing the total to 3,839 locations.

Breaking it down, food and beverage revenue nudged up 3.1% to $3.05 billion, but delivery revenue slid 14.1% YoY to $15.6 million, reflecting shifting consumer habits and heightened competition. Rising labor, occupancy, and operating costs weighed on margins, dragging adjusted net income down 2.7% to $450 million, with adjusted EPS amounting to $0.33, but in line with estimates. Investors weren’t thrilled, and no surprise, then, that CMG stock plunged 13% after the earnings call.

Still, Chipotle shows no signs of slowing, relentlessly pushing forward with its expansion strategy. The company opened 61 new restaurants in Q2, most equipped with Chipotlanes, its drive-thru format designed to accelerate digital and mobile orders. International growth is picking up, with Canada tripling sales in five years, Europe improving, and Middle East locations outperforming U.S. averages.

Looking ahead, Chipotle’s management forecasts flat comparable sales for 2025. However, it plans 315 to 345 new openings this year, with more than 80% featuring Chipotlanes, and targeting 7,000 units long-term in North America. Plus, it is confident that digital, operational, and expansion initiatives will drive average unit volumes (AUV) past $4 million and reignite mid-single-digit comparable sales growth.

Analysts monitoring Chipotle expect its fiscal 2025 EPS to surge by 8% annually to $1.21, before rising by another 17.4% YoY to $1.42 in fiscal 2026.

Chipotle’s Sky-High Delivery Plan

Chipotle’s taking its delivery game to an entirely new altitude – literally. Partnering with drone-delivery leader Zipline, the burrito giant has launched “Zipotle” on Aug. 21 in Dallas, testing an autonomous delivery system designed for the speed-obsessed consumer.

Customers place orders through the Zipline app, and within minutes, a quiet, zero-emission aircraft picks up the food from a “Zipping Point” at a local Chipotle. The drone then glides over traffic, gently lowering the order right at the customer’s doorstep – hot, fresh, and dine-in ready. Initially, deliveries will handle up to 5.5 pounds of food, with plans to scale up to 8 pounds.

The pilot run is limited to select Zipline users in Rowlett, Texas, but a broader rollout is expected if demand soars. It is aimed at younger, delivery-driven consumers. And if that momentum sticks, along with flying burritos, maybe CMG’s struggling stock can get the boost it needs.

What Do Analysts Expect for CMG Stock?

Analysts are starting to lean bullish on Chipotle despite its bruised stock chart. Last week, Piper Sandler upgraded CMG from “Neutral” to an “Overweight” rating, but trimmed its price target to $50 from $53. The brokerage firm believes much of the negativity is already baked into CMG stock. Piper’s base case assumes 3% comparable sales growth over the next two years, even if mid-single-digit targets remain hotly debated, and argues the market is overly bearish.

Meanwhile, Raymond James’ Brian Vaccaro reiterated an “Outperform” rating but lowered the target to $56. The brokerage firm noted that July comparable sales were “noisy,” thanks to summer travel and calendar quirks. He also flagged that Chipotle’s value proposition is strong but under-communicated, suggesting that clearer messaging could drive further upside.

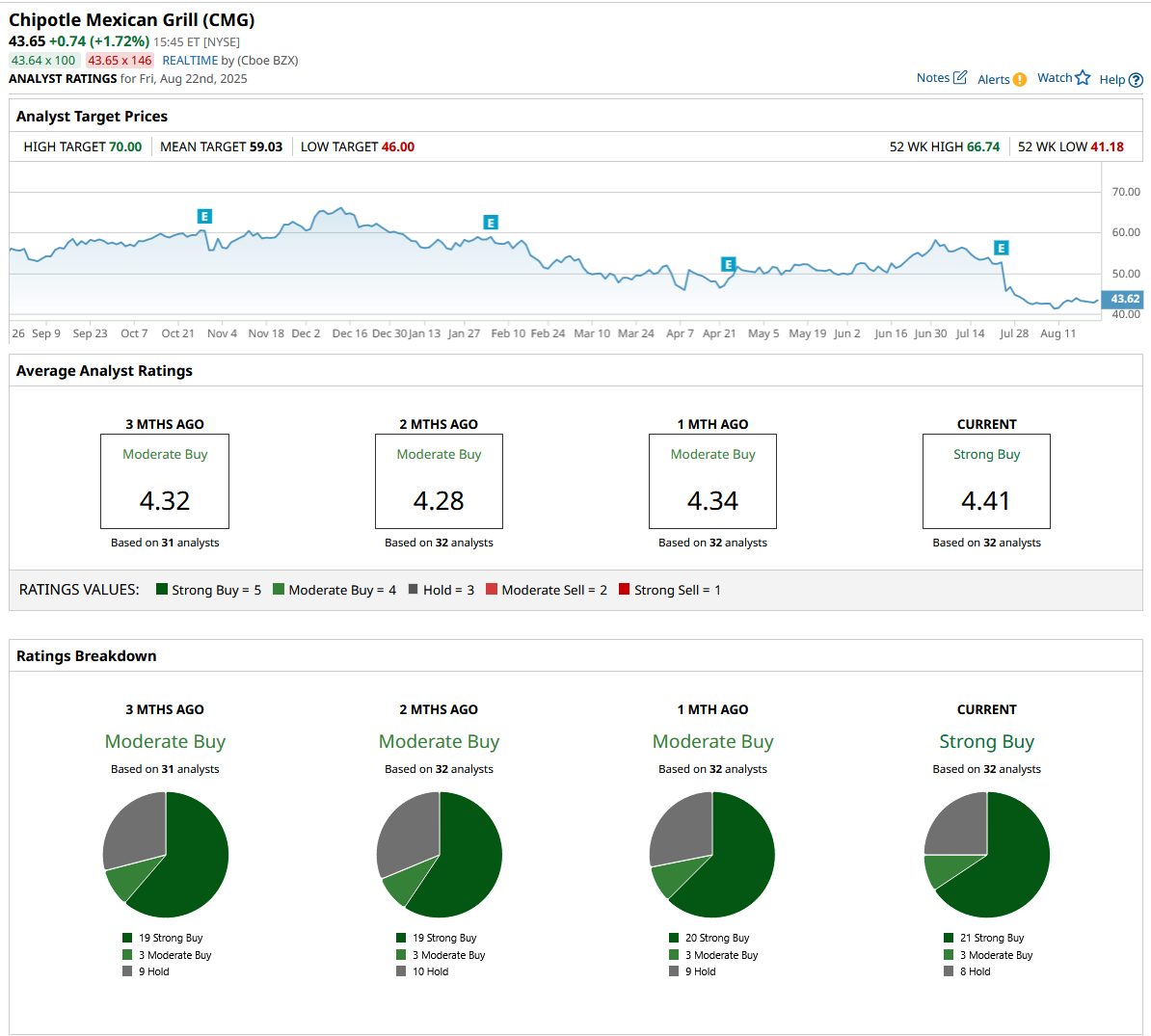

Wall Street is split, but optimism around CMG’s rebound is quietly building. The stock has an overall “Strong Buy” rating, an upgrade from the “Moderate Buy” rating it had a month ago. Of the 32 analysts covering the stock, 21 recommend a “Strong Buy,” three advise a “Moderate Buy,” while the remaining eight analysts are cautious, advising a “Hold” rating.

Plus, with a mean price target of $59.03, CMG has rebound potential of 37.6% from current price levels. The Street-high target of $70 indicates the stock could surge as much as 63.1%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.